News

LiveCom European Industry Survey reveals growth in first snapshot of the pan-European live communication industry

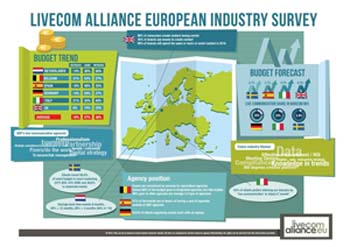

The first pan-European survey of the live communication industry, using data from seven countries, has revealed positive growth trends with an average of 83% of respondents expecting budgets to grow or stay the same across six key markets.

The LiveCom European Industry Survey 2016 captured existing data from Belgium, Germany, Italy, Netherlands, Spain, Sweden and the UK. More respondents expect budgets to increase than decrease in all markets except Belgium, where 4% more expect a decrease. The Netherlands (56%) and Italy (49%) had the highest number of respondents expecting budget increases.

The LiveCom European Industry Survey 2016 captured existing data from Belgium, Germany, Italy, Netherlands, Spain, Sweden and the UK. More respondents expect budgets to increase than decrease in all markets except Belgium, where 4% more expect a decrease. The Netherlands (56%) and Italy (49%) had the highest number of respondents expecting budget increases.

Using data gathered after the Brexit referendum result, the UK market was broadly cautious with as many as 74% expecting budgets to remain the same while it also had the lowest expectations of falling budgets – just 6%. The rate of expected budget growth was higher in the UK (6.3%) than in Italy (4.3%), Spain and Sweden (both 3.7%).

The LiveCom Alliance European Industry Survey aims to capture the scale, trends and economic impact of the live communication industry in the world’s biggest free trade area. The 2016 edition is the first step towards building a comprehensive picture of this important industry. The LiveCom Alliance, the association which collates data provided by its member associations, will produce future editions of the survey annually to coincide with the EuBea Festival.

Six countries are showing substantial budget growth expectations for events; average growth expectation (36%) is double the expectation of decrease (18%). General event marketing budgets are rising by between 3.7% and 6.3%. And live communication and events are showing a substantial share of the total marcom budget.

Looking at the position of agencies in our industry, the results show opportunities for both 360degrees agencies as well as specialized agencies. In general the market is evenly split, with some clients preferring the integrated approach while a similar number believe in working with a select number (average of 3) of specialized agencies. Understanding and thinking in multi-channel approach within event concepts however is a must for the future.

Creating effective live experiences is not about putting together several elements, it’s a highly skilled craft, a specialty. Agencies breathe this craftsmanship 24/7 and offer professionalism and a crucial network of suppliers, mostly close partners working together in co-creation to get the best of the best for clients. In addition to important but commoditised assets like ‘fixers who do the work’ and ‘risk management and security’, It’s about strategic thinking and offering integrated concepts.

In our future it’s about effective measurement (ROI), integrated digital strategy and event design. These are obvious themes which have been around for a while, but this underlines the importance of dealing with them, understanding them and anticipating them. Challenges in compliance are expected and knowledge of trends and innovation are demanded.

How to describe what the services we offer is an interesting question and there is still no final answer. Besides a slight preference for live communication in Italy, it’s a mix mostly used as a combination in order not to miss any single element. At the 2016 advisory board meeting of the EuBea Festival, an event was defined as: ‘a live experience, planned in advance, in a limited period of time, with the objective of affecting the perception or behaviour of the audience, duly included in the marketing mix’. Overall the phrase live communication is widely accepted and approved as the most vivid and lively way to describe our industry.

Maarten Schram, Founder and Chairman of the LiveCom Alliance, commented: ‘We are delighted to publish this first edition of the LiveCom Alliance European Industry Survey. We want to build on the simple foundations we have now established and produce a bigger survey in 2017. We are exploring our own market research, focussed on specified numbers working towards our ultimate goal of creating a value of what our pan-European industry is worth and how many people it employs. We believe this will demonstrate the contribution live communication makes to the European economy and support its continued development.’